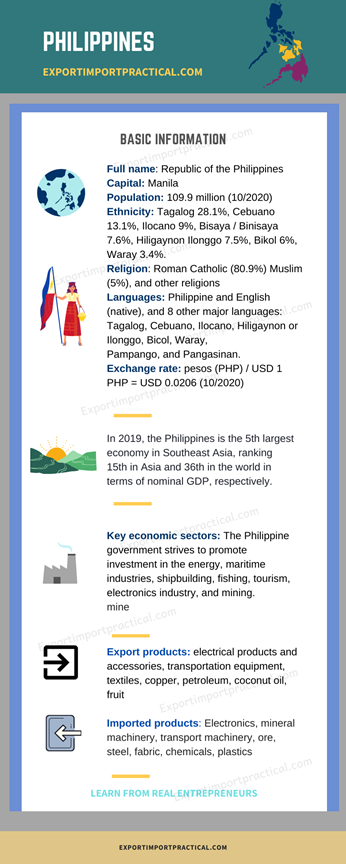

So, you want to start an export-import business with the Philippines, but you don’t know how to do it and don’t know about the country. This article will help you understand the export-import business opportunities, challenges, and business environment in the Philippines. We have put together a useful resource to help you exporting to the Philippines or start your business in this country. Hopefully, you will get many export-import business ideas regarding the Philippines after this reading.

1. The Philippines – business environment

Many foreigners are afraid that the Philippines is a place with many natural disasters and unfavorable business conditions. The Philippines is indeed a country with many natural disasters and social instability. However, this country also has many opportunities for international entrepreneurs.

So is the Philippines a reliable place to start and grow your international business? Or how about exporting to the Philippines or importing from there? Or as a foreigner, what are the greatest import or export opportunities with this country? How are the import requirements in the Philippines? We are getting a lot of questions related to the previous.

Peculiar to the Philippines

- Firstly, the Philippines has a lot of English-speaking people, more than 90 million. It is easier for you to negotiate without having to hire a translator. Moreover, Filipino workers are hard-working and responsible. Their productivity is superior in Asia, so it is very potential to build a business here as a foreigner (in case you have a good idea of what to produce).

- Secondly, on natural disasters, localities across the country are very active in setting up disaster reduction departments at regional, provincial, and city (town) levels. As a result, although being slow, disaster risk reduction has been paid more attention.

- Thirdly, the Philippines has a favorable business environment. For exporters, the Philippines market is relatively new with increasing purchasing power. Because it is a developing economy It wants to attract other businesses and investments, and international entrepreneurs are welcomed, also importers and exporters.

The following part is about the business and foreign trade (export and import) situation and opportunities in this country.

The Export-import business and trade in the Philippines

The Philippines is a country rich in natural resources with many minerals such as gold, copper, iron, chromium, manganese, coal, oil, and gas. In 2004, the Government estimated the total reserves of minerals in the ground are about 800 to 1000 billion USD. However, the Philippines currently only exports about $ 0.5 billion of minerals a year.

The Philippines is mainly an agricultural country. The development level is still low with GDP per capita is 4,500 USD (2011, ranked 156 globally). The population is occupied mainly on agriculture.

Agriculture accounts for 12.3% of GDP. The main crops are rice, maize, coconut, sugarcane, banana, pineapple, coffee, tobacco, cotton, jute, beans, and abaca plants for fiber. In the past, the Philippines’ industry dominates by mining, timber, and food processing. Some emerging industries are electronics and apparel exports.

The Philippines export-import destinations are the US, China, Hongkong, Germany, Thailand, and Japan. Oil, coal, iron, and steel, construction materials, machinery, food, chemicals are the import products.

2. Main export products of the Philippines

Because the Philippines is an agricultural country, then lof of its export items are related or originated from agriculture.

- Products related to coconut (coconut oil, coconut cake)

- Sugar and related products

- Fruits, vegetables (pineapple, banana, mango)

- Agricultural products (fish, shrimp, raw coffee, seaweed, natural rubber,

- raw tobacco

- Products related to wood

- Metal products (copper, iron, gold, nickel)

- Manufacturing industry (electronics, fabrics, and textiles, footwear, suitcases, bags, furniture,

- furniture, medicine, processed food, children’s toys, machine parts, or isometric convenient traffic)

* Main trading partners of the Philippines: Hong Kong, USA, Japan, China, Singapore, Indonesia, Malaysia, Korea, Taiwan, Thailand.

Read also: How to start an export-import business with japan.

Below are some of the very strategic and common products for the Philipphines

Coconut products

The Philippines is the 2nd largest coconut producer in the world after Malaysia. In addition to the burgeoning coconut oil production process, the Philippines also derives large commercial revenues from the prestigious coconut industry. The Philippines sells more than 70% of coconut oil to the export market, of which about 80% goes to Europe and the United States.

The Philippines earned $ 1.7 billion from exports of coconut in 2016. Most of the export revenue is coconut oil, accounting for 80.5% of the total export turnover.

Read also: How to start export import business in Malaysia.

Banana

Banana exports account for about 30% of the total agricultural export with a value of $ 6.39 billion in 2019. The Philippines is still the second-largest banana-growing country in the world, after Ecuador.

The banana agriculture industry of the Philippines is facing competition from other banana exporting countries. Although Japan and Korea still maintain banana consumption, banana exporting countries in Latin America are scrambling for export market share with the Philippines.

Mango

The mangoes originating in the Philippines are famous for being the sweetest in the world. Ideal conditions for mango trees to flower bear fruit due to the dry air caused by El Nino wind.

However, the mango export still has many limitations for the inefficient chain of cold storage management. Exporters do not meet the standards of consumer markets for packaging and handling. Pre-export treatment includes sanitary and phytosanitary measures.

Nickel

The Philippines is currently the world’s second-largest supplier of nickel ore, after Indonesia. The new nickel mining regulations will affect 29 out of 48 operational mines.

The country’s nickel ore production in the first half of 2018 fell 10% year-on-year to 9.43 million tons. Up to 11 nickel mines in the Philippines are banned or suspended and need upgrading to meet the new mining standards.

Read also: Indonesia export and import products.

3. Main import products of the Philippines

Below are some of the most common product categories what the Philippines is importing.

1. Rice

In 2019, the Philippines imported 2.9 million tons of rice. The rice imported into the Philippines has nearly quadrupled in the past three years and accounts for about 7% of the total rice imports worldwide.

2. Machine products, electrical equipment

Currently, the electrical machinery and equipment that Philippine businesses want to import include electrical machinery, equipment, electrical cables, lighting equipment. If you are from a country, which is producing technically high level and quality machinery, then you may have a great export opportunity.

Specifically: voltage stabilizers, electrical panels, power plugs, power outlets, capacitors, switches, circuit breakers, electric meters, transformers, electrical wiring ducts, types cables, cable trays, conductive cores, terminal boxes, inverters, power conversion systems, industrial pumps, transformers, water meters.

4. Guide for exporting to the Philippines

If you have found a product you wish to export to the Philippines, then you need to know how exactly you can get that product to the country and allowed it to be released for the local consumers. You need to know the import-export procedures and documentation. Below we are pointing out the most important parts and aspects you shall pay attention to when doing business with local Philipines partners and exporting to the Philippines.

International sales-purchase contract

It is an indispensable and crucial part of any international business transaction or export activities. The sales-purchase contract confirms the transaction details that the parties have agreed upon and committed to performing. That is why the contract is the basis for the parties to perform their obligations and at the same time requires partners to perform their obligations.

The exporter is obliged to transfer ownership to another party called the buyer (importer) of a given product. The buyer is obliged to receive the goods and pay the money

Read also: Export import documentation and procedures.

Import requirements in Philippines

Goods exported into the Philippines by air or by sea must complete an import customs procedure:

(1) Providing a export documentation of the goods to the custom.

(2) Inspection and evaluation

(3) Payment of taxes

(4) Release of goods from customs areas

Philippine Customs applies official import declaration and non-trade declaration. The non-trade declaration applies to commercially imported goods of less than USD 500 or to portable household goods of no commercial value. The official statement applies to the remaining cases.

All importers or their agents must submit import declarations to the Philippine Bureau of Customs (BOC), after which the data will process through the Automated Customs Operating System (ACOS).

Documents needed when exporting goods to the Philippines include:

- Commercial invoice

- Bill of lading/ air waybill

- Certificate of origin (if required)

- Packing list

- Import license for importer (applicable to required items import license)

- Certain special certificates of the quality of the goods shipped by sea and/or as required by the terms of the importer/bank/ letter of credit.

Export/import license

In the Philippines, there are still two different procedures for granting import licenses, one for non-quota goods and one for items subject to quotas. Permits for non-quota imports are usually issued immediately. But the applications must be submitted at least two weeks before the date of goods arrival.

Licensing registration fees are classified by product and collected by the licensing office.

Import taxes in Philippines

Products that cannot produce domestically are subject to low import duties, while imports that compete with domestic goods are subject to higher taxes. All tariffs are taxes calculated on the price of goods, which is to calculate transparency and predictable.

Other taxes and fees In Philippines

Most of the imported items are subject to a 12% value-added tax like those produced domestically. Items not subject to value-added tax include agricultural and marine food, agricultural raw materials, petroleum products, books, newspapers and magazines, freight ships, or passenger- ships of 5000 tons.

Imported goods are subject to several customs fees, including processing, administration, registration, and laboratory fees.

Payng taxes in Philippines

Import duties are paid together with all taxes and other shipping charges before receiving for consumption. Tax payments are made via banks and electronically linked to the tax authorities.

According to the on-Line Release System (shipping; Philippines) (OLRS), when paying taxes through banks has been notified to the tax authorities, the opposite tax authorities will then unlock the taxes paid and allow the operating the port for the importer or the importer’s representative to receive the goods.

Regulations on packaging and labeling

Every country has its own rules and regulations related to the imported product’s labeling, marking, and packing. Below is the most important information regarding the marking of exported goods to the Philippines.

All imported or home-made goods need to show the following information:

- Names of registered goods;

- Legally register the trademark;

- Address of manufacturer, importer, or packer of consumer products in the Philippines;

- The general composition or composition of the product;

- Net weight, calculated in meters;

- Country of manufacture, if imported

- The mark must state the re-stocked or repackage under the original license from the manufacturer.

The authorities may request the following additional information:

- Products are flammable or not flammable

- Instructions for use, if necessary

- Warning on toxins

- Electricity (in watts), voltage (in volts),

- The production methodology used if needed.

Items banned from exporting to the Philippines

The following items cannot be imported into the Philippines unless licensed under strict regulatory conditions:

- Explosives, gunpowder, firearms and other explosives, shotguns and war weapons, and other parts are not allowed unless authorized by the competent authority;

- Chlorofluorocarbon (CFCs) and halons and ozone-depleting substances

- Illegal goods, tools, drugs, and substances intended or used to perform an illegal abortion

- Roulette wheels, roulette, dice, cards, machines, appliances, or mechanical devices used to gamble or distribute money

- Marijuana, opium, poppies, coca leaves, heroin, or any other narcotic or synthetic drug that is considered a substance by the decision of the President of the Philippines, or any compound, salt, derivatives, except when imported by the Philippine government or any individual authorized by the Poisons Council, for use only for medical purposes;

- Used clothes and rags

- Toy guns and explosives

- Vehicles driving with the opposite hand

- Laundry detergent and industrial-containing heavy surfactant.

In addition to the above items, the following items are allowed to be imported into the Philippines only after obtaining declarations and licenses from competent government agencies:

- Cattle, poultry, maize, potatoes, and coffee meat (Quota Management Council / Ministry of Agriculture)

- Acetic anhydride (Toxicology Council) Department of Trade Promotion

- Sodium Cyanide (Department of Environmental Management)

- Penicillin and its derivatives (Department of Food and Drug Administration)

- Refined petroleum products (Department of Petroleum Industry Management)

- Coal and coal derivatives (Department of Petroleum Industry Management / National Energy Corporation)

- Fish products (Department of Fishing and underwater resources)

- Plant biotechnology and plant products (Plant Department)

- Color reproduction equipment (Department of National Inspectorate / Central Bank of the Philippines)

- Chemicals for producing explosives (Philippines National Police)

- Pesticides, including agrochemicals (Fertilizers and Pesticides Committee)

- Automobiles, parts, and components (Department of Import Services)

- Used tires and tubes, used cars and trucks (Import Services Department)

- All types of warships (Ministry of Defense)

- Radioactive materials (Philippine Nuclear Research Institute)

- Legal currency exceeds 10,000 Pesos (Philippines Central Bank)

- Wood materials (Department of Forest Management)

Read also: Risk and how to manage these in business

5. Establishment of business in the Philippines

Investing and starting a business in the Philippines

When investing in the Philippines, foreign investors are guaranteed the following benefits:

- To enjoy tax and other non-tax preferences;

- Transfer investment capital to partner or move back to your country;

- Transfer of profits abroad;

- Foreign currency loan contract;

- Freely export its products;

- Not be nationalized, requisitioned, or confiscated;

- Investment incentive policy of the Philippines;

- Income tax exemption for six years if investing in encouraging fields: production and processing of goods, raw materials, formulas, designs, methods, technological processes.

Procedures for establishing a business in the Philippines:

- Get the certificate of deposit at the bank’s capital in cash of the business.

- Check that the name of the business you intend to set is the same as the Philippine Securities and Exchange Commission (SEC). Read, how to choose a name for the company.

- Registration of transactions with the Foreign Exchange and Securities Commission.

- Get a tax certificate (CTC).

- Submit an application for certification from the local government of the business headquarters.

- Get an operating license from the mayor’s licensing office.

- The mayor’s office conducts a physical inspection of the business.

- Buy accounting books.

- Registration of value-added tax (VAT).

- Pay the VAT registration fee.

- Receive authorization to print invoices from the Department of Domestic Revenue (BIR).

- Collect receipts and invoices at the print shop designated by BIR.

- Submit receipts and invoices to BIR.

- Register with the social security system (SSS).

- Register with the Philippine Health Insurance Corporation (PHIC).

6.The best way to find buyers/clients/customers

If you have found the potential products you would like to export to the Philippines, then in order to start exporting, you need to find customers for your business. You should have a systematic export sales and marketing strategy and plan. All start from the planning, and at first, you should make sure: 1) who are the customers, 2) what channels to use to reach them, 3) what are the market prices, 4) what information is important to them.

If you are targeting Philippines importers from an overseas country, then you could consider the following channels and tactics to find local importers.

- Find local import agents and let them find a local pot customers

- Use trade portals to find purchase requests for your products from the Philippines.

- Contact the Philippines chamber of commerce and other trade institutions and ask for the contact details of the targeted companies

- Use the internet, contact directly the companies you know are potential customers

- Travel to the country, visit potential customers ( if possible to travel)

- use the options of digital marketing, and channels like Linkedin, google advertising.

Notes for digital marketing planning

It will be beneficial for your business to collect insights from your customers before leveraging digital marketing. To get this info, you can discuss with some real customers about your products and services. Make sure what kind of information about your products is actually important and engaging for the customers.

Use experts (Specialists writers, advertising designers, etc.) to conduct advertising campaigns.

Coordinate, manage, and ensure that the advertising campaign is carried out as planned, on schedule, and with the expected budget.

Always side by side with customers in advertising projects, always consider the feedback from the customers.

7. Participate in export-import bidding/tenders

For some products, it is possible to find tenders or bids, where you could participate, so we also explain the nature of tenders in international business.

Bidding is the process of selecting contractors to sign and perform import-export transaction contracts. The goal of this is to find a contractor (or investor) that satisfies their technical requirements, quality with the lowest cost, thereby bringing tremendous benefits to the buyer.

Bidding is a trading method for large-scale transactions that require efficiency and transparency. Therefore, all professional businesses, if you have enough capacity, can participate in bidding.

Bidding and tenders are commons for big companies and government institutions.

To participate in bidding and achieve the goal of winning purchase contracts in the Philippines, contractors must improve themselves in all aspects, including access to bidding information exploitation.

You can search for opportunities to participate in a bid, such as using the invitation to bid application, attending meetings or seminars.

Tenders, where you could participate can be found in many ways. It is possible to use the help of a local agent to find tenders. Secondly, you could ask for help from the Philippines chamber of commerce and ask the information about the on-going tenders in your area.

Conclusion

After all, the Philippines is very different from the rest of Asia. The country has no overwhelmed religious places or a shopping paradise. However, because of its new and unspoiled nature, the Philippines will be an attractive destination to start a business. More and more companies want to invest there and open offices there.

The Philippines business environment is not too harsh, but there are growing numbers of opportunities. You need to research the market before deciding to import from there or export to this country.

We believe that no matter where you do want to start a business, thorough research is essential. If you are wondering how to start an import-export business, we suggest joining our online courses and programs to learn practically, how to do international business. We make sure you will be taken care of throughout the learning process to have a solid foundation for the business.

If you want to learn how to start your own export-import business online or offline, then we have online courses and programs which will give you the best guide to start an international business from scratch. We have also tools and resources which help you to grow and expand your business and get more customers and raise profitability.

You are advised to take courses and use the resources ad tools listed below:

- Export-import business courses and programs

- Most popular online exim course: “Zero to first deal“

- Resources and action plan for exporters/importers, online sellers.