Are you pursuing your import/export business dream in Singapore? Perhaps you are a foreigner in Singapore and looking to start your own exporting business there? Would you like to get some great import/export business ideas to get started in Singapore? Or do you want to know, where to start with very little capital?

Import-export business in Singapore, there are many opportunities, important is to focus in the right potential areas, sectors and plan your journey well.

Before we go on to the article we want to inform you, we have online export-import courses, and a personal business mentoring program to support you in this business. We advise you to check our programs out and enroll first in our most popular and free online export-import business course below.

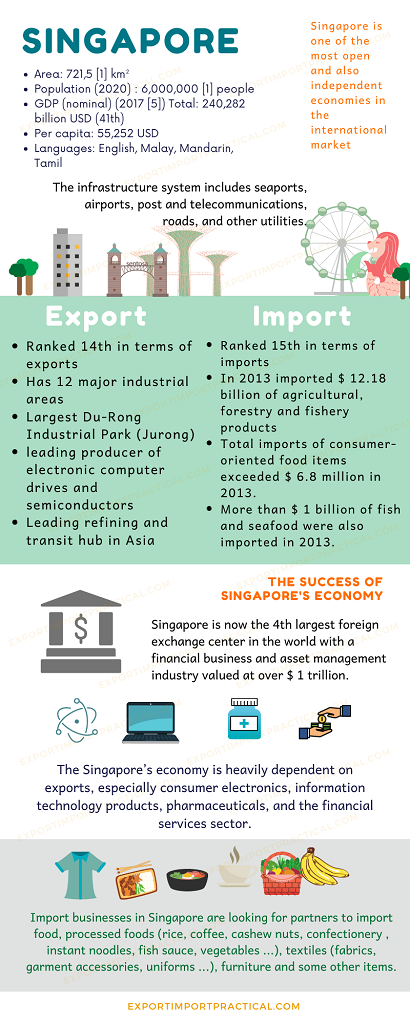

Overview about Singapore

Singapore is one of the most open and independent economies in the international market, ranking 14th in exports and 15th in imports and manage assets worth more than $1 trillion.

Building modern and efficient infrastructure is seen as a foundation for the success of Singapore’s economy.

The infrastructure system includes seaports, airports, post and telecommunications, roads, and other utilities. Which helps Singapore to have high per capita income, life services, and social security.

Export sectors of Singapore

Singapore has developed industries in seaports, including shipbuilding and repair, oil refining, processing, electronics and mechanical assembly.

That means, Singapore is a leading manufacturer and supplier of electronic computer drives and semiconductors and oil refining, Singapore is a transshipment hub in Asia. Singapour is a unique city-state, similar to Hong Kong. Singapour and Hong Kong are competitors in terms of attracting investments, companies’ headquarters.

Indeed, Singapore is dependent on exports, such as consumer electronics, information technology products, pharmaceuticals, and the financial services sector.

Import sectors of Singapore

In 2018, Singapore imported $ 16.18 billion of agricultural, forestry, and fishery products. The United States is the 5th largest supplier to this market, with an import value of 954 million dollars. Malaysia, France, Indonesia, and China are the top four markets for this city-state.

Total imports of consumer-oriented food items exceeded $ 9.8 million in 2018 and $ 2 billion of imported fish and seafood.

For one thing, Singapore local import businesses are looking for the products such as: food, processed foods (rice, coffee, cashew nuts, confectionery, instant noodles, fish sauce, vegetables); additionally, textiles (fabrics, garment accessories, uniforms); also furniture and some other items. All these products can be supplied from nearby ASEAN countries like Vietnam, Thailand, Cambodia, Malaysia. Singapour belongs to the ASEAN.

Read also: Export business opportunities in Vietnam

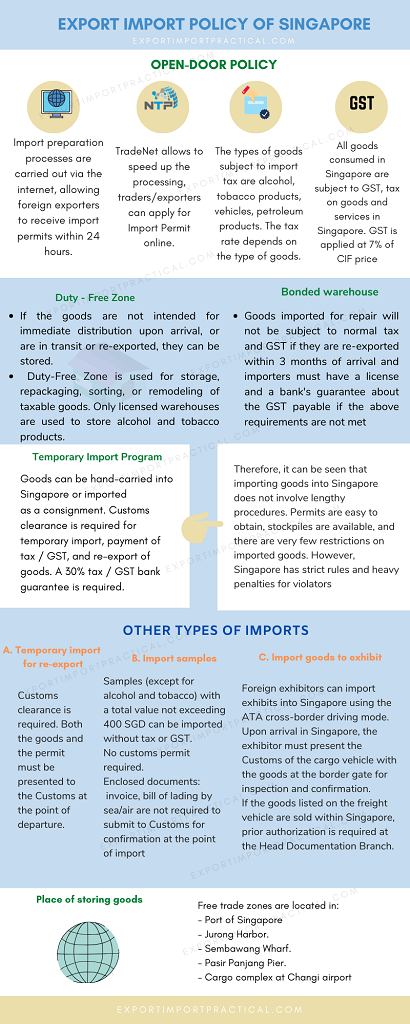

Export import policy of Singapore

Singapore has implemented an open-door policy. Import preparation processes are via the internet, allowing foreign importers to receive import permits within 24 hours.

All goods consumed in Singapore are subject to GST, tax on goods and services in Singapore. As of July 2007, GST was at 7% of the CIF of price.

Apply for import-export licenses

For importing/exporting all goods: For importing all goods (including controlled and non-controlled items) into Singapore, you need to have an import permit through TradeNet® before the goods are into Singapore.

For exporting all goods (including controlled and unregulated items) out of Singapore, you must have an export license through TradeNet®, you will have to do it when:

- Before exporting goods out of Singapore (if they controlled or transported goods on rail or road)

- Within three days of export if they controlled or shipped goods on sea or air.

- Imported goods previously from exporting temporarily imported for re-export.

- Then exporting temporarily exported goods.

Some circumstances like importing/exporting commercial samples of uncontrolled items with a total value not exceeding SGD 400 / – on the CIF price (costs, insurance, and freight) can do import/export without a license.

Singapore customs fees

Singapore Customs charges a fee for administrative procedures.

The most efficient way is to pay all fees, taxes, and GST to Singapore Customs through the GIRO, which allows Singapore Customs to make a deduction directly from your bank account.

Trade finance and insurance

In Singapore, businesses often use loans, letters of credit, and insurance to cover financial risks associated with transactions.

Major export products of Singapore

Pharmaceuticals

Singapore is one of the few countries in the world to export super pharmaceuticals.

The US, Europe, and Japan have been the largest export destinations for Singapore’s pharmaceuticals. The demand for drug storage has contributed to the increase in Singapore’s exports.

Specifically, In 2019, Singapore’s export turnover of pharmaceutical products reached $ 8.1 billion, the import reached $ 3.1 billion. It is related to the Covid-19 pandemic.

In particular, Singapore’s biomedical industry employs more than 24,000 workers, accounting for 20% of the workforce. This sector contributes about one-fifth of Singapore’s GDP in 2019.

Computer drives and semiconductors

Singapore is a leading producer of electronic computer hard drives and semiconductors. Consequently, Singapore and other Asian economies that are heavily dependent on exports have surged since 2017 on the back of improved global demand, especially for electronic products and components such as semiconductors. With this category, Singapour is competing with Taiwan and China.

Finished products

Singapore is an exporter of finished products (coffee, tea, coke products, spices, beverages, fish, seafood, and tobacco products). The tobacco and the beverage-food manufacturing industry reached $ 9 billion in 2017, of which more than 50% were re-exporting.

These products are beer, non-alcoholic beverages, oils, chocolates, processed seafood, milk powder, condensed milk, sauces, and seasonings.

Major import products of Singapore

Meat and poultry

Singapore imports meat and poultry from all over the world. Poultry and pork products are widely consumed here.

For example, chicken meat is supplied through the import of frozen chicken (whole and partially) from Brazil, the United States, China and Europe.

Fruits, green tea leaves

The major suppliers of tropical fruits to Singapore are the United States, Australia, New Zealand, Europe, China, South Africa, Argentina, and Chile, Malaysia, Indonesia, Thailand, and Vietnam.

Families in Singapore prefer green tea leaves from China, Malaysia, Indonesia, Thailand, and Vietnam. Australia, New Zealand, Europe, and the United States mainly imported vegetables.

Seafood

About the seafood, Singapore imported from Malaysia, Indonesia, China, and Vietnam. Some other suppliers are Norway, Thailand, Japan, Australia, and India. In 2018, Singapore’s total imports of seafood were the US $ 1.8 billion.

Woods

Singapore’s import value of wooden furniture in the first four months of 2019 reached 80.1 million USD. Singapore imports wooden furniture mainly from Malaysia and China, with the value of imports from these two markets accounting for 71.1% in the first four months of 2019. Vietnam is increasing its market share with the furniture as well.

How to start an export business in Singapore

Singapore is a small country with no natural resources, so this country depends heavily on imports. Singapore has implemented the open door policy, so exporting to Singapore is very simple.

What is the first things to do to export to Singapore?

To be able to export to Singapore, products are subject to strict quality control, technical standards. Singapore has strict rules with heavy penalties for violators.

Step 1: Partner with an importing company

A Singapore-based company partner is required to be an importer or a distributor. These import companies will have to do all the import procedures such as customs declaration. It is convenient because can declare the forms online, and this importer already registered.

Step 2: Register with Singapore Customs

All importers and exporters must activate their account in the Singapore Customs before import-export goods in Singapore.

To get a Custom Account, you need to prepare the following information:

1. Business information

2. Information on the Main Contact Person

3. Communication with Second Contact Person

4. Contact information for the individual who will receive a notification when the @Tradenet license is registered under the UEN company identification number is approved.

5. Employee information who the business owner wants to authorize to access and activate Custom Account.

Step 3: Check if the exported goods are being controlled

To check the goods attributes in Singapore, businesses can check the HS code (Harmonized System code) or contact the Singapore customs to receive the code costs around SGD 75 per product (Please Note: This eight-digit HS code check will only have political updates valid in Singapore)

Step 4: Register an Interbank GIRO Account

It required to have an Interbank GIRO Account by Singapore Customs to pay taxes, GST, and other charges.

Once an IBG account is approved, businesses can e-file to authorize a declaring agent to deduct tax payable directly from the IBG account.

If the business does not open an IBG account with Singapore Customs, there will be a deducted tax and GST to the declared agent account.

Step 5: Payment guarantee

Businesses must conduct payment guarantee operations (bank guarantee/finance company guarantee, insurance bond) for transactions related to taxable goods, temporarily imported goods, or payment operations. Charges when using the areas’ service licensed by the customs (tax suspension area, bonded warehouse).

Step 6: Apply for a customs export license

Businesses can:

• Appoint a declaring agent to obtain customs clearance on behalf of the business; or

• Apply for an import license for your own business or for your customers (if the applicant is a declaration agent).

You should submit all license applications via Singapore Customs’ @TradeNet

The application form usually priced at SGD 2.88

Step 7: Prepare the documents for the Cargo Clearance

With the goods imported by sea, the company does not have to present the printed copy of the customs permit and supporting documents (supporting documents) to the checkpoint officers at the entry checkpoints.

For imported goods in containers by air or road, the enterprise must present the import permit and supporting documents such as (invoice, packing list, airway bill) for the Verification checkpoint staff.

Besides, businesses need to keep commercial documents related to the purchase, import, sale, and export of goods for five years from the date of approval of the customs permit.

Can store these documents in hard copies or as images.

It obliges for businesses to keep the commercial documents and present them at the request of the Customs.

Signing an international contract (for all exporters and importers)

To avoid risks, businesses involved in the international sale of goods must enter into an international goods sale and purchase contract.

Compulsory forms for international goods sale and purchase contracts are in writing or other equivalent forms such as

– Fax copy;

– Telegraphs, computers;

– Soft documents (like email …)

Legal aspects of an international goods sale and purchase contract in some of the following:

– Offer and conclude a contract.

– The rights and obligations of the parties.

– Contract breaches and remedial measures.

– The problem of transferring risks.

The parties’ laws will govern other issues. Therefore, the understanding and application of the Convention provisions is an essential task for enterprises signing international contracts.

The function of resolving disputes (including disputes over commercial contracts) through the arbitration mechanism belongs to the Singapore International Arbitration Center (SIAC), a completely exclusive organization established with the Chamber of Commerce and Industry in Singapore.

The Center has Arbitration Rules (SIAC Rules) based on the Model Law issued by the United Nations Commission on International Trade Law (UNCITRAL) and recognized by Singapore law (Singapore’s International Arbitration Law).

Singapore’s selection of the Singapore International Arbitration Center for contractual dispute resolution is voluntary for the involved parties . The Contract Dispute Settlement Terms specify for that.

Read also: Export-import documentation and procedures.

Read also: Biggest risk in export-import business and how to manage these.

The most profitable export ideas in Singapore

There are some lucrative products to export to Singapore as it is essential that Singapore need.

Water

Singapore doesn’t have pure water, they have to import water from another country like Malaysia. (That’s why in Singapore water is about 5–6 SGD/bottle, it is expensive, but people can drink tap water everywhere if you can supply qualified bottle water with a good price it will be very profitable business)

Cars

in Singapore, people can have cars and vehicles for only ten years to protect the environment. Singapore has to import cars and it is very expensive. People all need cars, they expect good price cars if you can supply them.

Foods

fruits, meat, eggs, rice, noodles are all very expensive in Singapore, if you have qualified food products to export to Singapore don’t miss that opportunity.

Luxury goods

hand watches, necklaces, jewelry, branded clothes, and cosmetics. Also branded wines from Italy, France. All that is associated with luxury and elegance.

Do export marketing to Singapore

Understand the general tastes and preferences of Singaporean consumers

Usually, importers and agents representing foreign brands will be responsible for market development, building advertising and promotion strategies, and strengthening distribution channels in the retail market. Every business will have a different marketing plan to export their products.

Usually, supermarket chains and a few luxury product retailers import products directly from source countries, collectors, and distributors to sell in their stores.

Smaller retailers usually import goods from local distributors.

Products imported directly to Singapore are usually fruits, jams, confectionery, cookies, salad dressings, packaged deli meats, and temperate fruit.

Products imported by local importers include products from Asia, dry groceries, tropical fruits, frozen chicken, chicken parts, frozen beef, sauces, and national food.

High-end brands capture the public’s imagination by standing out from the crowd. For instance, besides providing the best products, you should also focus on the best customer service. Singapore is a highly competitive environment, which many exporters around the world are targeting.

How to import goods from Singapore for the beginners

Step 1: Select the product to import

You have to research the products before importing them, for example:

Health and beauty care products such as Makeup, shower gel, body skincare are the ideal product niches in Singapore. In addition, the wholesale price is also quite low and the quantity is not too large.

Computer accessories, phones: USB, laptop shockproof bag, laptop battery, computer speaker, Bluetooth speaker, you can buy wholesale in large quantities, good price, and not too difficult to source.

Product size and volume are also important to pay attention, especially if you want long-term business. A compact product (under 1 lb ~ 450 grams) not only helps you minimize shipping costs but also optimizes product storage space. As the order grows, stocking of the product is essential. The compact product will definitely save you a lot of warehouse rental costs.

Step 2 Collect the pre-orders (For low-budget business)

For new and small businesses, you should consolidate pre-order and order so that there is no inventory without too much capital.

After a period of acquaintance with customers and acquiring a certain level of prestige, you should collect cheap goods in bulk before gathering customers.

For a reasonable price, you should collect goods from major brands in the sale-off seasons, sometimes cheaper than 1/3 of the selling price. The expiry date is still comfortable over one year.

Step 3: Make payment

If you agree with the quotation provided by the seller, you can confirm the order. Then proceed to make the contract, you will sign and pay from 70-100% of the order value depending on the contract required.

Step 4: Ship booking

If importing goods from Singapore by sea, you need to book a ship. Before performing this step, you need to sign a sale contract.

Usually, shipping lines will run out of seats a week before, especially when it falls in the peak season. When booking a ship to import, you only need to provide information for the FWD transport service in your country to get your booking. They will then contact your partner to coordinate packing according to the previously defined plan.

Singapore companies are importing a lot of goods from China and Hong Kong for re-exporting purposes. Therefore it would be also interesting to read how to import from China.

Conclusion

Import-export business is a stage of foreign trade activities that affects many other industries. Export is an indispensable industry for all countries because it brings a high source of foreign currency to help increase imports of goods and create jobs for people.

Currently, there are many established companies in Singapore, most of them are importing from nearby ASEAN countries and China and reselling to Europe. But if your plan is solid and you have a focus on specific products or industries and you have made sure, who are your target customers and how to sell to them, then definitely there is a chance to build a profitable international business for you.

If you want to learn how to start your own export-import business online or offline, then we have online courses and programs which will give you the best guide to start an international business from scratch. We have also tools and resources which help you to grow and expand your business and get more customers and raise profitability.

We advise you to take courses and use the resources ad tools listed below:

- Export-import business courses and programs

- Most popular online exim course: “Zero to first deal“

- Resources and action plan for exporters/importers, online sellers.